ipru-breakout abovr 50ma(.0028)

Posted: August 3, 2012 Filed under: Uncategorized | Tags: ipru Leave a comment

Following 10ma

Posted: July 31, 2012 Filed under: Uncategorized | Tags: cnbc, jim cramer, mad money Leave a comment

(S)SPRINT-Caution-wait for pullback in the 4.15,before-re-entry

Posted: July 31, 2012 Filed under: Uncategorized | Tags: cnbc, jim cramer, s Leave a comment(S)SPRINT-Caution-wait for pullback in the 4.15,before-re-entry

OVERBOUGHT!!!!!!!!!!!!

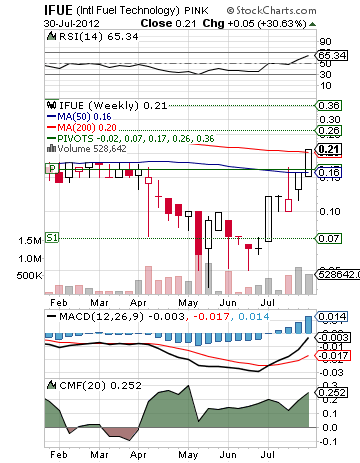

(IFUE)on watch forTODAY!!!-could run easily from .21 to .26-then .36

Posted: July 31, 2012 Filed under: Uncategorized | Tags: cnbc, jim cramer Leave a comment(IFUE)on watch forTODAY!!!-could run easily from .21 to .26-then .36

Posted: July 30, 2012 | Author: profitman7777 | Filed under: Uncategorized | Tags: Business, Clocks and Watches,cnbc, Collecting, Goddard Space Flight Center, James Webb Space Telescope, jim cramer, mad money, Recreation,Shopping, squak box, stocks, Watches | Modify: Edit this | Leave a comment »

IFUE: watch this stock in tomorrow’s trade – currently the .17 – .18 appears a good bid consideration point

(S)SPRINT-clear sailing till $5.15-If that falls-the $8.00 area will be tested!!!!!

Posted: July 30, 2012 | Author: profitman7777 | Filed under: Uncategorized | Modify: Edit this | Leave a comment »

SHOULD SEE SMOOTH SAILING TILL $5.15

Sprint Nextel Corp

Posted: July 30, 2012 | Author: profitman7777 | Filed under: Uncategorized | Tags: cnbc, jim cramer, mad money |Modify: Edit this | Leave a comment »

|

|||||||||||||||||

MONEY

Posted: July 30, 2012 | Author: profitman7777 | Filed under: Uncategorized | Modify: Edit this | Leave a comment »

test

Technical Event® Alerts at Close of Business July 30, 2012

Posted: July 30, 2012 Filed under: Uncategorized Leave a comment| Technical Event® Alerts at Close of Business July 30, 2012 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following alerts have been triggered. Each alert may produce a list of up to 50 Technical Event® opportunities matching the selected criteria. If you find that the list of matching Technical Event® opportunities is too long, try narrowing your alert criteria. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: SLV – Any Technical Events Alert Criteria: SLV (NYSE); Classic Patterns; Short-term Patterns; Indicators; Oscillators; Any Opportunity Type (Bullish, Bearish or Other); Daily and Weekly Events. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: New Alert Alert Criteria: Stocks (Any US Exchange); Classic Patterns; Any Opportunity Type (Bullish, Bearish or Other); Daily and Weekly Events; Possible Price Move of at least 30%. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(*) Indicates the instrument has reached the target price on the same day the pattern was confirmed. Accepted principles of technical analysis suggest that no further price movement should be attributed to this pattern. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: New Opportunities Alert Criteria: Stocks (Any US Exchange); Price 0.01 to 2.00; Volume at least 200,000; Short-term Patterns; Bullish; Daily Events. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: USA, Bullish Alert Criteria: Stocks (Any US Exchange); Price at least 0.01; Volume at least 50,000; Classic Patterns; Bullish; Daily Events; Pattern Duration at least 35 days. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Technical Event® Alerts at Close of Business July 30, 2012

Posted: July 30, 2012 Filed under: Uncategorized | Tags: chart patterns, cnbc, jim cramer, mad money Leave a comment| Technical Event® Alerts at Close of Business July 30, 2012 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following alerts have been triggered. Each alert may produce a list of up to 50 Technical Event® opportunities matching the selected criteria. If you find that the list of matching Technical Event® opportunities is too long, try narrowing your alert criteria. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: SLV – Any Technical Events Alert Criteria: SLV (NYSE); Classic Patterns; Short-term Patterns; Indicators; Oscillators; Any Opportunity Type (Bullish, Bearish or Other); Daily and Weekly Events. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: New Alert Alert Criteria: Stocks (Any US Exchange); Classic Patterns; Any Opportunity Type (Bullish, Bearish or Other); Daily and Weekly Events; Possible Price Move of at least 30%. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(*) Indicates the instrument has reached the target price on the same day the pattern was confirmed. Accepted principles of technical analysis suggest that no further price movement should be attributed to this pattern. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: New Opportunities Alert Criteria: Stocks (Any US Exchange); Price 0.01 to 2.00; Volume at least 200,000; Short-term Patterns; Bullish; Daily Events. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert Name: USA, Bullish Alert Criteria: Stocks (Any US Exchange); Price at least 0.01; Volume at least 50,000; Classic Patterns; Bullish; Daily Events; Pattern Duration at least 35 days. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Buy Sprint Nextel? Cramer’s Take!

Posted: July 30, 2012 Filed under: Uncategorized | Tags: 4G, AT&T, Customer, IPhone, jim cramer, Sprint Nextel, Verizon, Wireless Leave a comment

Alert Criteria: Stocks (NASDAQ); Price at least 0.001; Volume at least 500,000; Classic Patterns; Bullish; Daily and Weekly Events; Possible Price Move of at least 50%.

Posted: July 30, 2012 Filed under: Uncategorized Leave a comment| Symbol | Exchange | Name | Event | Close at Event | Target Price Range | Opportunity Type |

| MPEL | NASDAQ | Melco Crown Entertainment ADR Reptg 3 Ord Shs | Continuation Wedge (Bullish) | $10.25 | $16.50 – $17.75 | Intermediate-Term Bullish |